Self Employment Invoice

Staying organized with your finances is simple with QuickBooks Self-Employed a mobile app that makes it easy to stay in control of your business finances and helps you prepare for tax time while on the go with effortless expense mileage invoice and HST tracking all in one place. Snap photos of receipts for easy expense tracking.

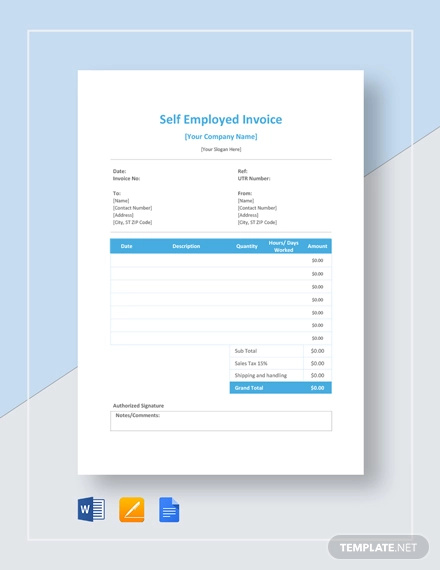

Self Employed Invoice Template Pdf Templates Jotform

You must include the following information on your invoices in France.

. Invoice for your pay instead of getting a wage. These forms prove your wages and taxes as a self employed individual. Discount available for the monthly price of QuickBooks Self-Employed QBSE is for the first 3 months of service starting from date of enrollment followed by the then-current fee for the service.

Are able to work for different clients and charge different fees. Online competitor data is extrapolated from press releases and SEC filings. Directors of a limited company.

There are essentially two ways to become an autónomo in Spain. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. Take a look at the documents below to see what you can use to prove your income when you are self-employed.

Concept Development and Feasibility Study. Please contact us if your client is an existing Nationwide borrower and cant meet the required criteria as some applications can be referred to our senior underwriters. You can either apply for a self-employed work visa or modify an existing work permit.

To be eligible for this offer you must be a new. Ie if you are a non-EUEFTA citizen living outside of Spain or you are already living in Spain on. Get a 30-day free trial.

Professional invoices are one. 1 online tax filing solution for self-employed. Self-Employment Comprehensive Business Plan.

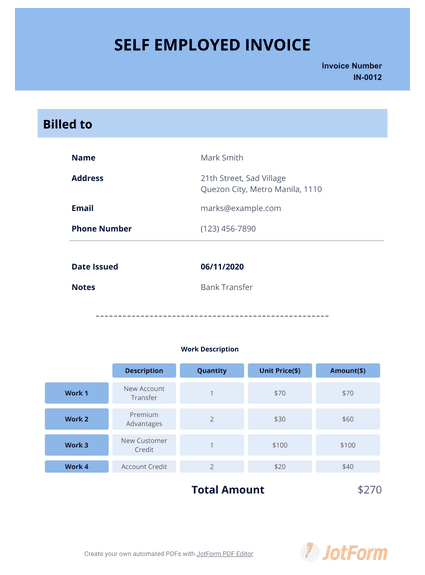

Are able to send someone else to do the work for you if appropriate. Description of service or sale. Date of the invoice.

Customer Profile and Self-Employment Exploration. Self-employed individuals must pay self-employment taxes as well as income tax on their profits. In other words self-employment tax applies to freelancers who make over 400 in self-employment income excluding church employee income.

Self-Employed defined as a return with a Schedule CC-EZ tax form. In addition to regular income tax freelancers are responsible for paying the self-employment tax of 153 in 2021This tax represents the Social Security and Medicare taxes that businesses pay and that employees have taken out of their paychecks. Wage and Tax Statement for Self Employed.

What you pay taxes on however will depend on the formula of business earnings minus business expenses which gets you to your magical profit number You only have to pay Medicare and Social Security taxes on your. Having a Self Employment Declaration Letter helps the. Online is defined as an individual income tax DIY return non-preparer signed that was prepared online either e.

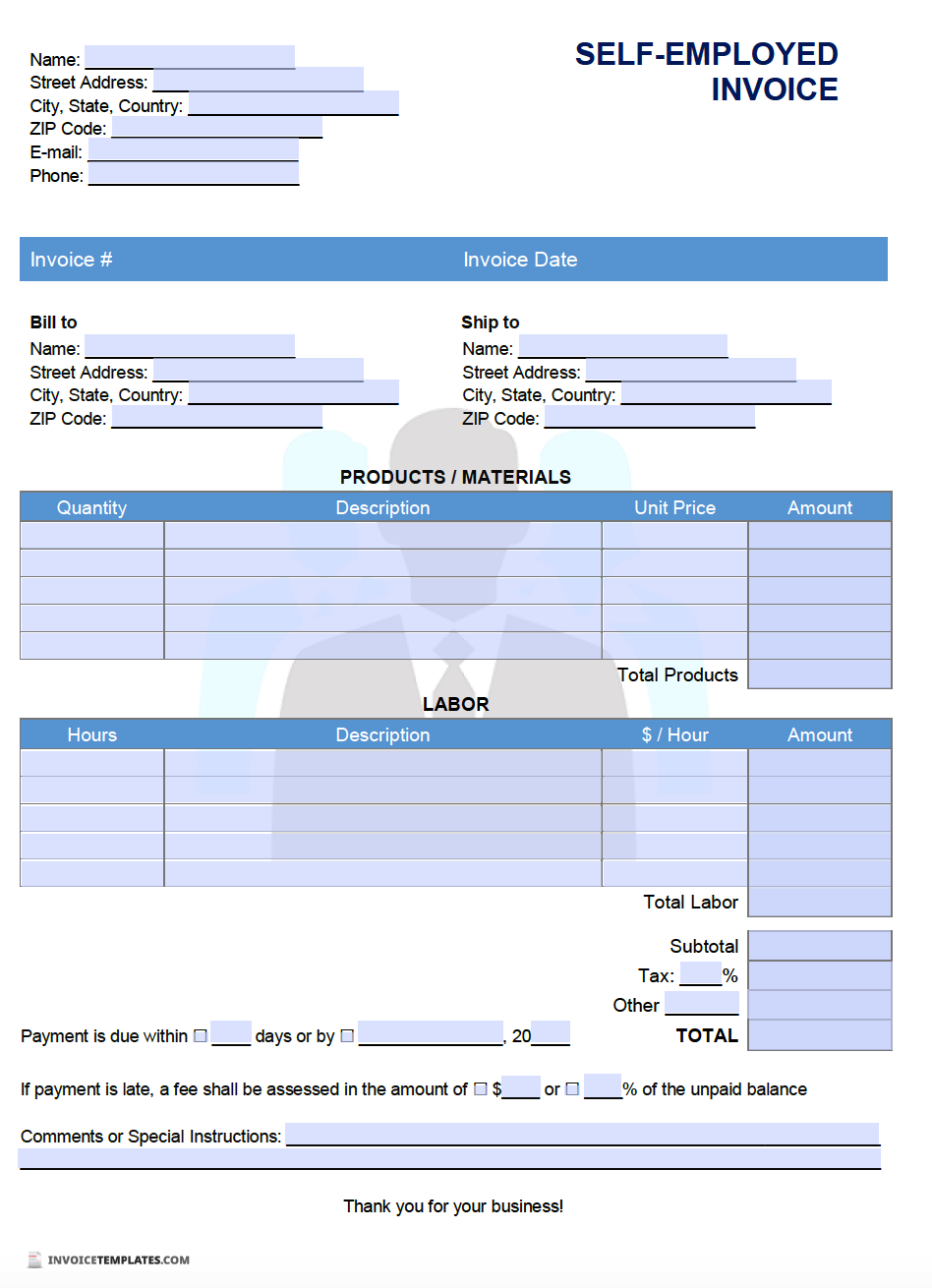

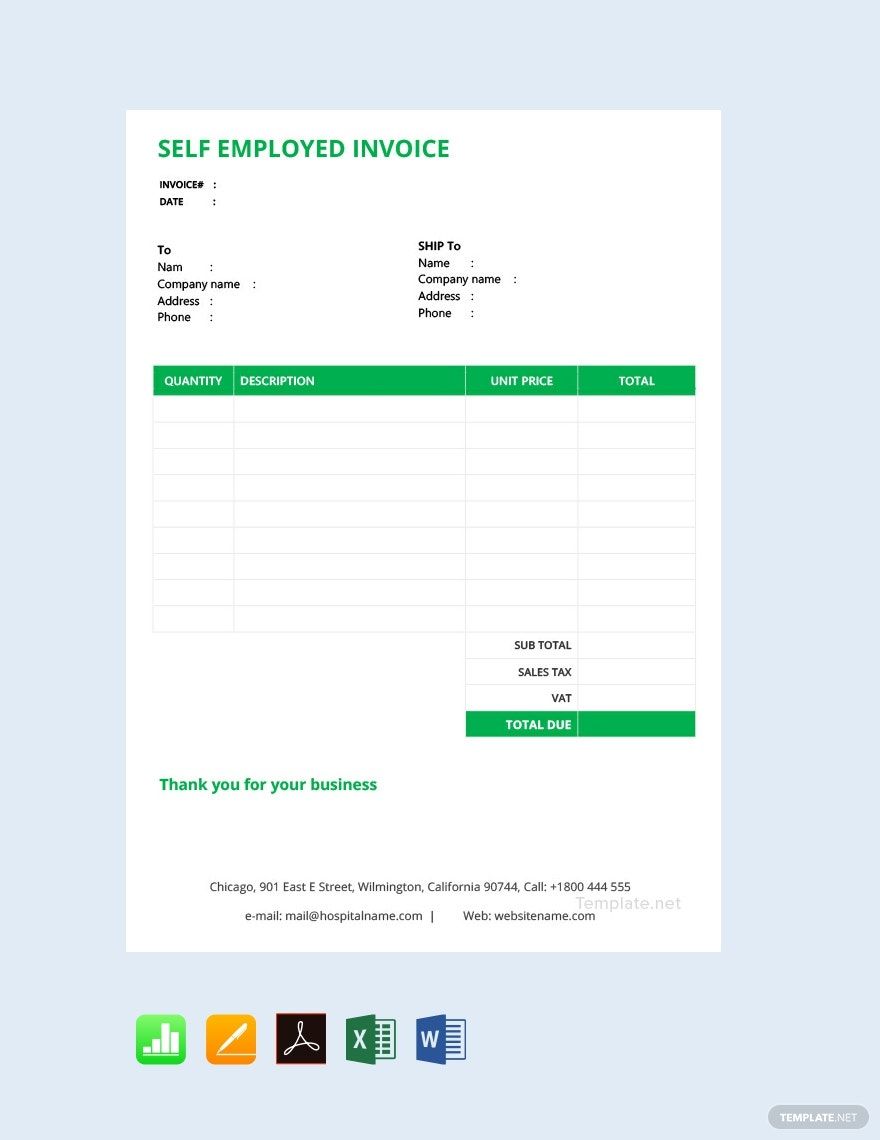

Your account will automatically be charged on a monthly basis until you cancel. You can do this yourself using a word processor or Excel but you could also use one of our free invoice templates above. Get contracts to provide services for clients.

If youre self-employed you have some employment rights including. How to become an autónomo in Spain. Theyre your evidence for your self-employment income tax declaration.

Naturally the method that you choose will depend on your current situation. Self-employed income Criteria and proofs required. Track self-employed business expenses with the QuickBooks Self-Employed mobile app.

Self-employment Ledger Templates This is a ledger document that shows employers or clients your details of cash returns. When youre self-employed you are your own bosswhich is great news until tax time. Self-Employment Simple Business Plan.

This letter declares the intention of the declarant to inform in a form of a document his or her work and the nature of the business he or she is in as well as the gross income for the past two years. You also need to file an annual tax return. You cannot charge VAT TVA so all invoices must include the words TVA non applicable article 293 B du.

A Self Employment Declaration Letter is a document that intents to disclose information about his or her work being self-employed. A devis is an estimate and a facture is an invoice. Well need to see the last 2 years income where well either use the lower of the most recent years salary and dividends or the.

Your invoices form a large part of your financial records and they need to be accurate. Protection for your health and safety on a clients premises. Use the Check Employment Status for Tax CEST tool to find out if you or a worker on a specific engagement should be classed as employed or self-employed for tax purposes.

Users of QuickBooks Self-Employed find an average of 4340 in tax savings per year. Accounting with live bookkeeping. Make your invoice look professional.

Date of service or sale. Organize books with a live bookkeeper. Track income send invoices and more.

Heres a quick summary. Its one of the. Proving income while self-employed can take a little extra effort if you dont keep yourself organized.

The first step is to put your invoice together. This document contains the details of an invoice and there are things must be kept in consideration when formulating this important document. Self-employment taxes include Social Security and Medicare taxes.

As a self-employed individual youre required to pay estimated taxes to the federal government each quarter. Continuously monitoring your income business expenses and tax deductions is how you meet your liability for healthcare social security and income taxes.

Self Employed Invoice Template Get Free Templates Freshbooks

Self Employed Invoice Template Get Free Templates Freshbooks

Self Employed Invoice Template Google Docs Google Sheets Excel Word Apple Numbers Apple Pages Template Net

Self Employed Invoice Template Get Free Templates Freshbooks

Self Employed Hours Invoice Template

Self Employed Invoice Template

Self Employed Invoice Template Get Free Templates Freshbooks